Stop Guessing Support

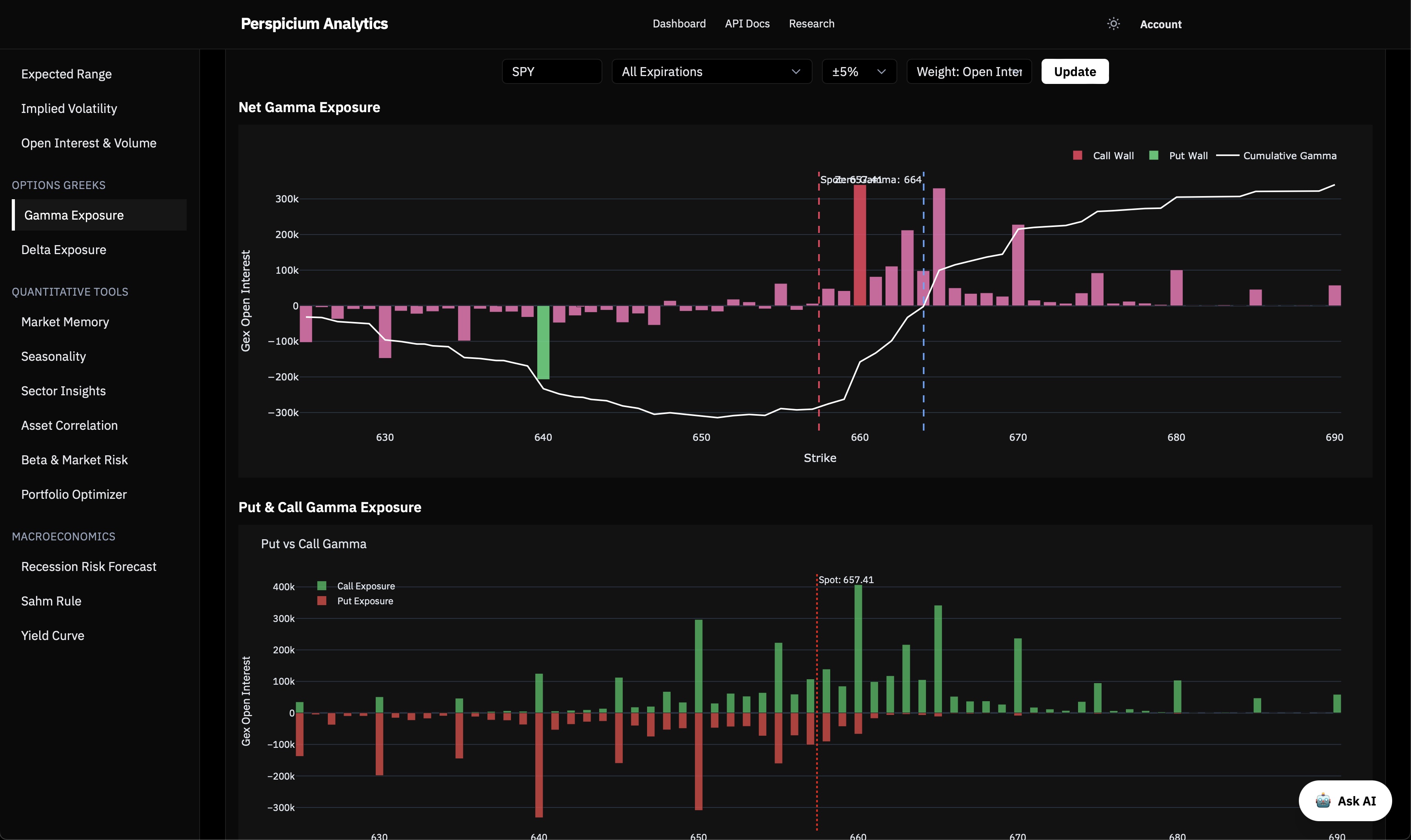

See gamma walls, vol triggers, and key strikes in seconds. Know exactly where dealers are forced to buy or sell.

Dealer positioning, volatility structure, and macro risk — in one workspace. Get key levels, regime context, and “what matters next” in under 60 seconds.

No credit card • 30 seconds • Save your dashboard & watchlists

Three quick checkpoints show you where dealers, volatility, and macro regimes line up—without jumping between tabs.

See gamma walls, vol triggers, and key strikes in seconds. Know exactly where dealers are forced to buy or sell.

Don't fly blind. Market Memory finds the closest historical price matches so you know the odds before you enter.

Get clear signals on recession risk and yield curve shifts. Know when the "easy mode" trade is over.

Pinpoint strikes with high gamma exposure (GEX) and follow smart money flow (DEX/UOA).

Explore GEX Tools →Stay ahead of the business cycle with recession probabilities and yield curve signals.

See Macro Models →Use Market Memory to find statistical edges and optimize portfolios with Markowitz theory.

Backtest Ideas →A simple workflow to validate your ideas.

Search any US equity to pull live options flow and volatility data instantly.

Check GEX levels, gamma exposure, and IV structure to spot dealer traps.

Confirm with macro models, then create a free account to track your watchlist.

GEX/DEX flows, macro risk, and historical analogs in one workspace.

Visualize dealer positioning and understand how hedging flows could impact volatility and price direction.

Get a forward-looking, data-driven probability of a US recession using our proprietary machine learning model.

Find the closest historical analogs to the current price action and see how those scenarios played out.

Built for traders who need answers fast. Ask "what matters right now?" and get a checklist of key levels, vol triggers, and macro risks.

"Is SPY in a positive or negative gamma regime?"

"Summarize the top 3 macro risks for this week."

"Find me a historical analog for today's price action."

Free during Founders’ Launch • Unlimited questions • Save chat history

Psi Analysis:

Positive GEX regime detected. Dealer hedging is dampening volatility. Key levels are $540 (Support) and $555 (Resistance).

The free tier is powerful. The Pro tier is for those who need to see every tick.

| Feature | Free (Founders) | Pro Edge |

|---|---|---|

| Data Latency | 15-min delayed | Real-time (Intraday) |

| Market Memory | Last 5 years | Full History (20y+) |

| Scanner Depth | Top 10 results | Unlimited |

P.S. Founders who sign up free today get an exclusive discount when we fully launch.

Concise breakdowns of Market Memory, IV term structure, and GEX/DEX—watch a demo, then jump right in.

Still have questions? Email us

Start free today. No credit card. Early adopters get an exclusive discount at full launch.

Founders’ Launch: 100% free • No credit card • Early adopter discount